Research “buying signals”, and you’ll find multiple examples: job ads, new company leadership, demo requests, pricing questions, expansion, VC funding, and the list goes on.

What’s harder to find? A clear, practical framework that explains what these signals mean, how much weight they carry, and what to do next.

Spotting a buying signal is only half the battle in closing sales opportunities. Interpreting that signal and nurturing the subsequent sales process is the other, often neglected, half.

Say a startup you’ve been tracking has just raised a series B funding. Does that mean they are ready to buy the solution/service you provide? Will the funding be used for expansion? And how do you respond to that signal?

In a world where 70% of businesses switch vendors when the sales rep doesn’t meet their key needs or the buying experience doesn’t feel right, understanding how to spot and respond to buying signals is crucial.

In this guide, we’ll give you the tools to interpret buying signals correctly.

We’ll walk through:

- What buying signals are

- The difference between weak and strong signals

- How to respond to signals with precision, using expert tactics and talk tracks.

What are Buying Signals?

Buying signals are clues that prospects are close to a purchase decision. They show up in different ways: verbally (like specific product questions), non-verbally (hesitation or urgency in their tone), or digitally (such as repeated visits to your pricing page).

A common way to interpret these signals is to map them to stages in the buying journey. Reps are often taught to think this way: see a signal, match it to a stage, and respond accordingly.

But the buying journey is non-linear, and doesn’t always give a full picture of the intent behind a signal. It’s more like a maze, with prospects revisiting earlier stages or skipping ahead unexpectedly.

For example, a prospect may read a case study today, ignore your emails for a month, suddenly send an email to request pricing, go back to reading another case study, and finally request a sales meeting.

A B2B SaaS buyers average 34 touchpoints before deciding and often include more than two stakeholders per deal.

For this reason, relying on the buyer’s journey alone will not be enough. To interpret signals precisely, you must look beyond when they appear and consider the surrounding context.

That starts with understanding the different buying signals and how they appear.

Types and forms of buying signals in sales

There are various ways to categorize buying signals. They include the following:

- Strength of intent (weak or strong): A buying signal can be weak or strong. Weak buying signals, like casual questions or increased email engagement, indicate lower interest. Conversely, strong signals like budget talks or pricing requests point to a prospect nearing a purchase decision

- Expression (verbal, nonverbal, or digital): Signals are either spoken (e.g., “How fast can we implement?”), action-based (e.g., nodding to what’s being discussed on the call), or digital (e.g., repeat visits to your pricing page).

- Source (company-level or individual): Some buying signals come from the entire company. This includes firmographics and events that suggest the company is ready to be sold to (like a recent fundraise, new hires, or a leadership change). Others come directly from a specific stakeholder, such as an individual requesting a free trial.

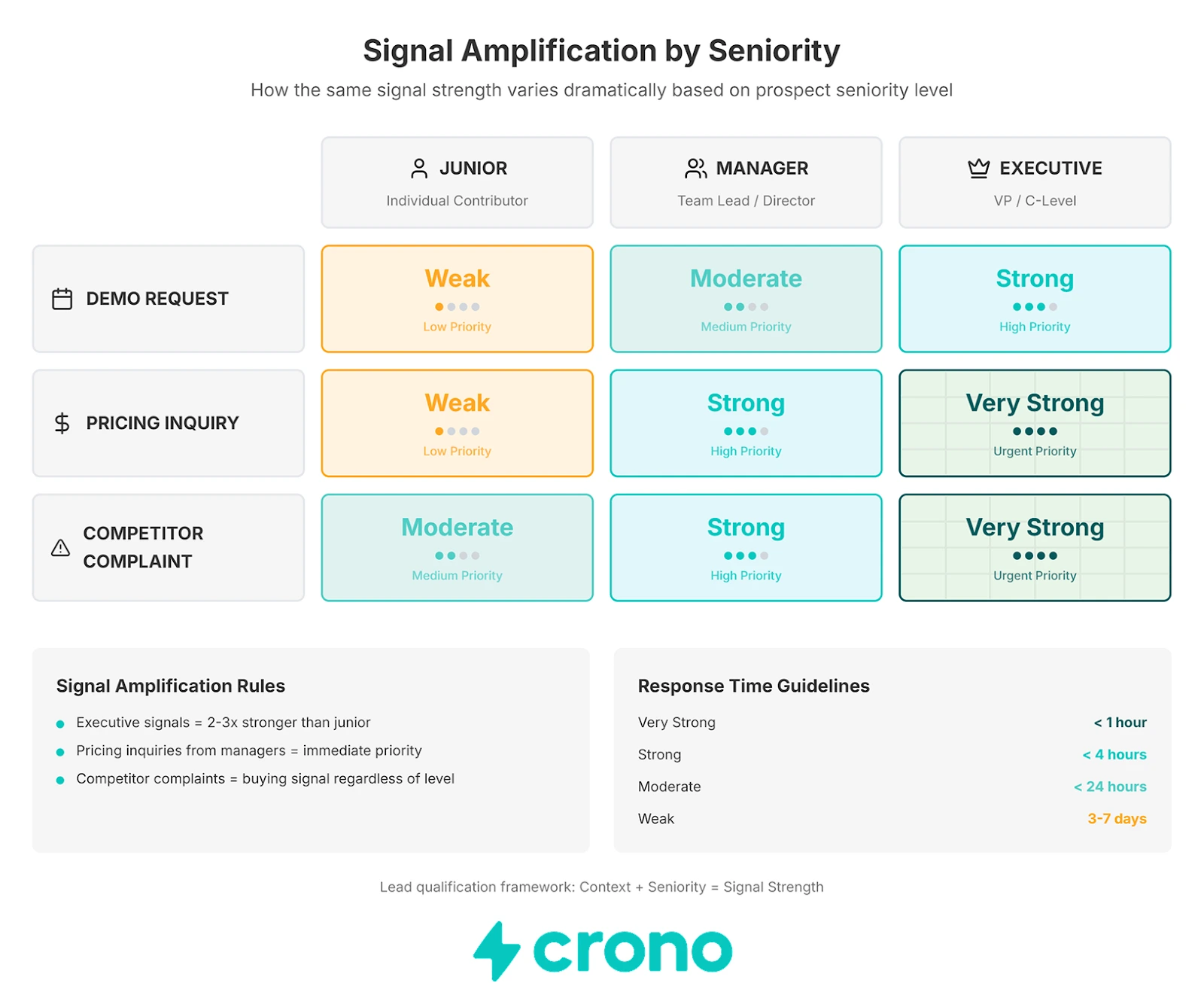

- Role (persona-level signals): The same action can mean different things depending on who’s doing it. For example, a sales champion requesting a demo differs from a CFO asking about contract terms. Understanding stakeholder roles is key to mapping intent and determining how to respond.

Among all these classifications, strength of intent is the most valuable. It applies across all other classifications and gives you the clearest sense of how close a prospect is to purchasing.

Knowing if a buying signal is strong or weak is a great way to read purchase intent, no matter the buyer’s stage, role, or how the signal appears. To that end, here are some actionable tips to help you distinguish between weak and strong signals.

What makes a buying signal strong or weak?

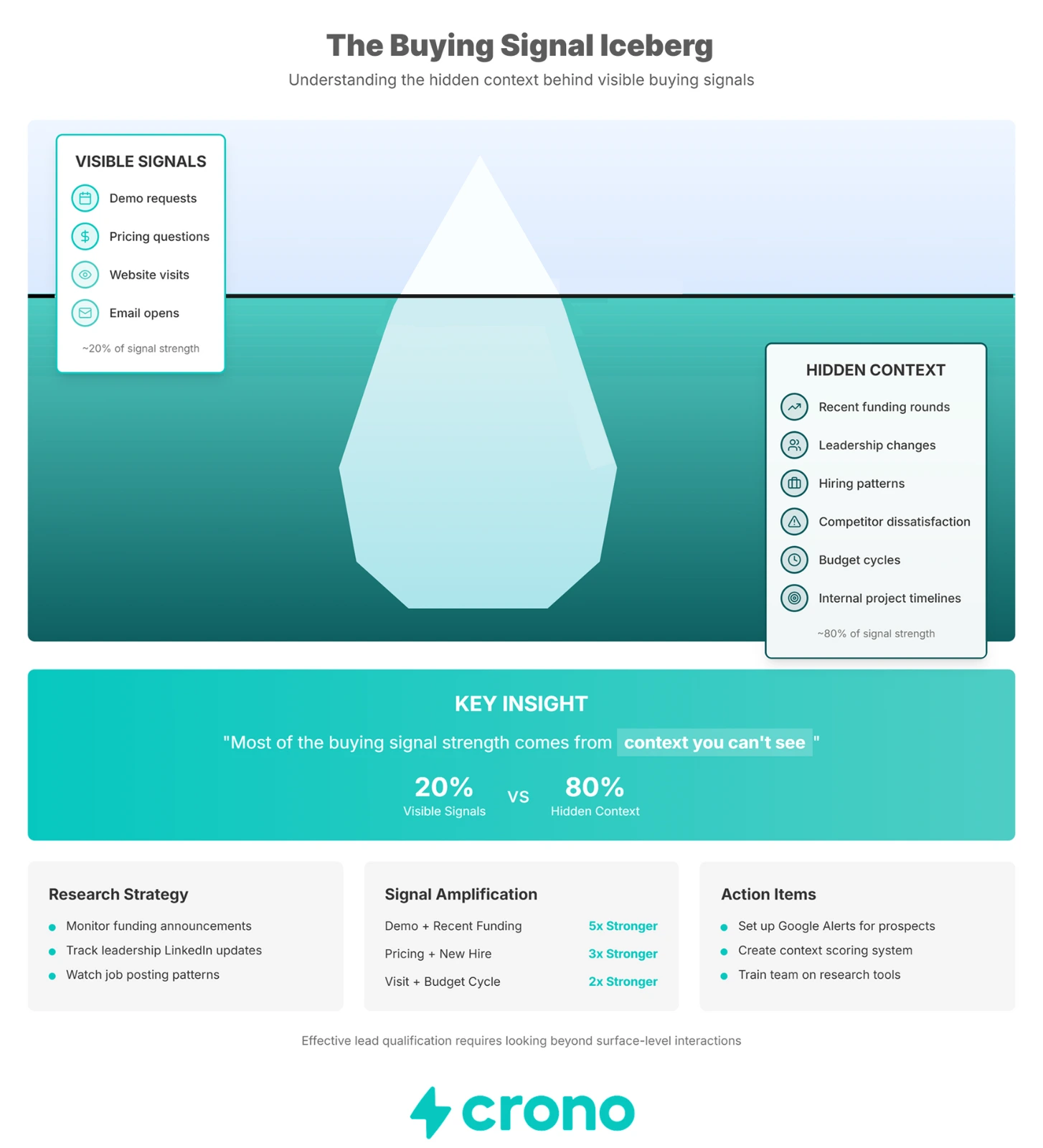

The context surrounding a buying signal determines whether it is a strong or weak signal. Of course, there are buying signals that are strong by default (such as a prospect requesting a pricing discussion); however, the additional context around that signal could strengthen or weaken it further. Think of it like an iceberg.

For instance, a single case study view might indicate casual interest. But if that same prospect also visits your product page, requests pricing, and signs up for a demo, the pattern points to high intent.

That’s why it’s critical to evaluate the strength of each buying signal, using contextual factors such as:

- Individual’s authority — A junior exec reading your case studies isn’t the same as a CFO asking about contract terms. The more senior and influential the persona, the stronger the signal.

- Buying journey stage — Buying signals increase in strength as a prospect progresses from initial problem awareness to active solution consideration and, finally, to the decision-making stage.

- Consistency — A one-off visit to your product page can be a weak signal. But it becomes a strong signal when the prospect keeps returning to your pricing page, opening multiple emails, or completing an interactive demo two times a week.

- Correlation with account-level data — Does this signal coincide with opportunity data like recent funding, new hires, or leadership changes? If yes, it’s a strong buying signal.

So, while there are general examples of weak and strong buying signals, you can’t determine the category of any signal in isolation. Context is everything.

Another important factor is the difference between buying and intent signals.

Intent signal vs buying signal

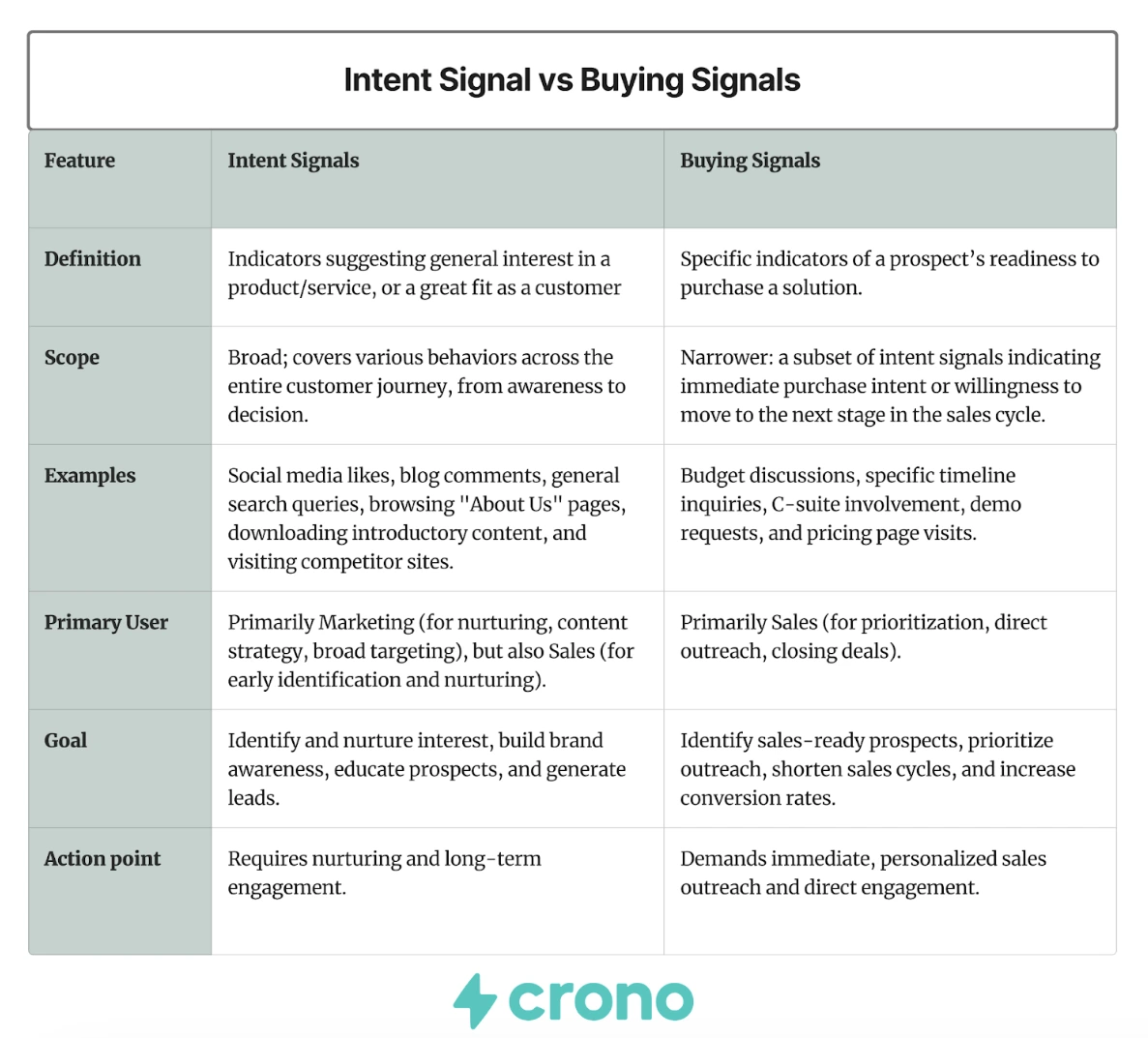

Intent signals show that a prospect is researching or exploring a product/brand, whether just browsing or looking for options. Conversely, buying signals strictly indicate a prospect is actively considering a purchase.

Not all intent signals indicate a readiness to buy. Only those that indicate real purchasing intent, based on the surrounding context, qualify as buying signals.

Here’s a quick breakdown of the differences between buying signals and intent signals:

Why does this distinction matter?

Understanding the difference between intent and buying signals is important because it gives your team insight into which accounts are ready to buy and must be prioritized.

Let’s say someone downloads a whitepaper. That’s an intent signal. It tells you the prospect is aware of the problem you are solving, but is not necessarily evaluating your product right now.

When you treat such intent signals and others like them as a buying signal, you risk:

- Allocating time and resources to prospects who aren’t ready to buy.

- Filling your pipeline with low-quality leads that never convert.

- Reaching out at the wrong time and coming across as pushy, damaging your brand, and making future engagement harder.

- Spending time on prospects unlikely to convert results in missing quotas, which drops morale and eventually leads to the departure of top performers.

That’s where understanding buying signals comes in.

Why buying signals matter

Buying signals matter because they reveal a prospect’s intent and readiness to engage, helping you tailor your next move to close the deal effectively. Accurately distinguishing buying signals from broader intent signals, and using them to build your sales strategy, unlocks real advantages:

- Prioritize sales resources smarter: Use hard data to prioritize quality leads and accounts. That way, you spend less time chasing low-intent leads and more time working accounts that are actively considering a purchase.

- Reach out when prospects are most likely to respond: Catching a prospect when they’re actively engaged—visiting your pricing page or comparing tools—makes it far more likely to respond.

- Make your outreach hit harder: Buying signals tell you what the prospect is interested in right now, which is way more useful than just knowing their industry or job title. This helps you tailor your message to prospects’ immediate concerns. As a result, the prospect sees you as a problem solver, rather than a salesperson looking to close a deal.

- Shorten your sales cycle: When you understand where a buyer is in their journey, you can skip generic discovery and jump straight to helping them evaluate and decide. That means fewer touchpoints, less back-and-forth, and faster closed deals.

- Provide a great customer experience: When your outreach reflects a prospect’s behavior and intent, it feels timely and relevant, not random. Instead of coming across as just another salesperson, you show that you understand their needs and can help solve their problems. This makes your message feel personal, not pushy.

Buying signals, whether strong or weak, all matter to your pipeline. Every signal is a clue in your prospect’s journey, which can be turned into a real selling opportunity with the right response strategy, tools, and processes.

Here are 11 buying signals and how to turn them into closed-won opportunities.

11 Examples of Buying Signals in Sales & How To Respond

The following is a list of 11 buying signals reviewed by their strength, buying journey stage, and a suitable response/action.

1. Positive body language cues

- Signal strength: Weak to moderate

- Buying stage: All through the sales funnel

As humans, our body language (posture, facial, and gestures) often reveals more than we realize. According to data sources, only 20 percent of our communication comes from our words, while 80 percent comes from our actions and gestures.

So, while listening to prospects on calls, pay attention to nonverbal cues—facial expressions, posture, tone changes, and micro-reactions. These reveal a prospect’s true feelings and interest, sometimes even contradicting what is being said.

Some examples of positive body language cues include:

- Leaning forward towards the screen, possibly to view a detail in your screen share

- Nodding while you speak

- Changing voice tone when you mention a product feature

- Taking notes as you speak

Conversely, crossed arms, distracted glances, or a forced smile might suggest skepticism or disengagement.

How to respond

a. Reference specific pain points or features discussed

“You seemed interested when we discussed [X]—is that a current challenge for your team?”

b. Provide targeted content based on their interest:

“I noticed you displayed interest in the Slack integration. Seems like async updates are a priority. I’m attaching a quick walkthrough, plus a case study from [Customer X] using this to improve internal ops.”

c. Plan next steps

Schedule follow-up meetings to build on the topics discussed

Pro tip:

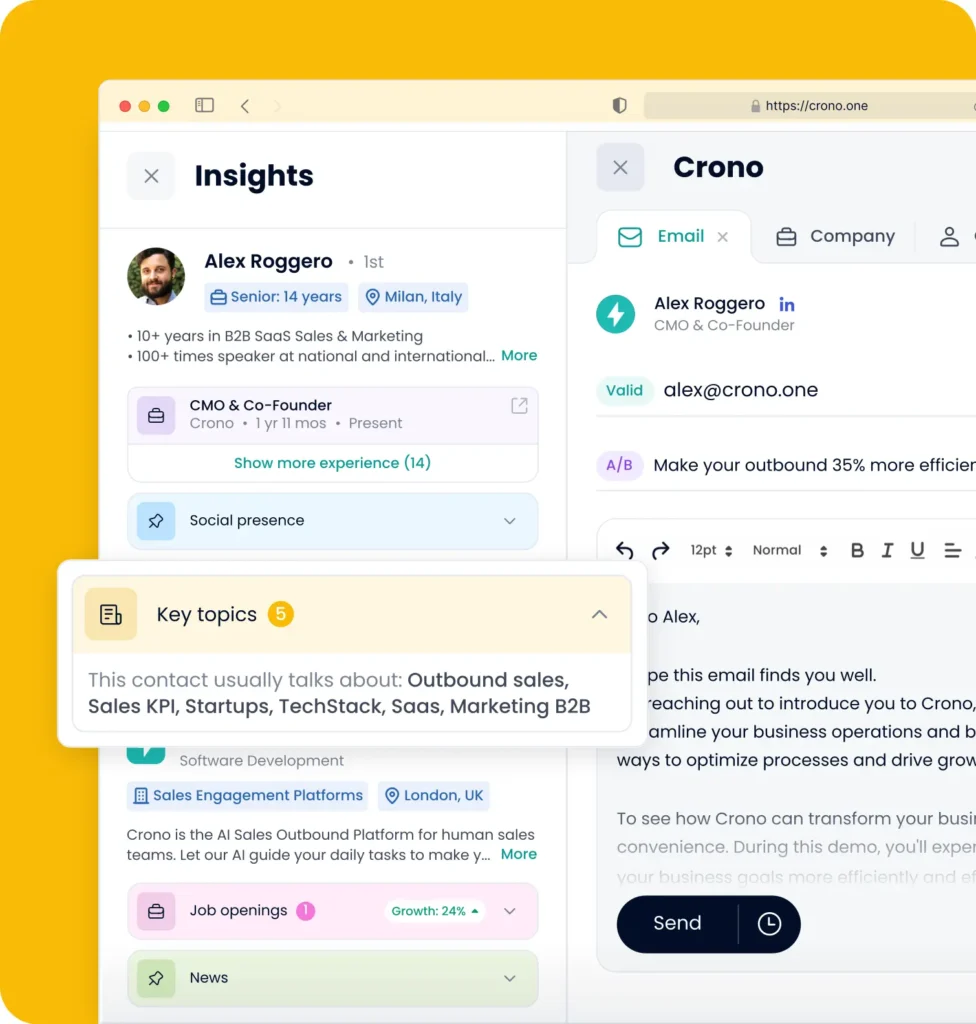

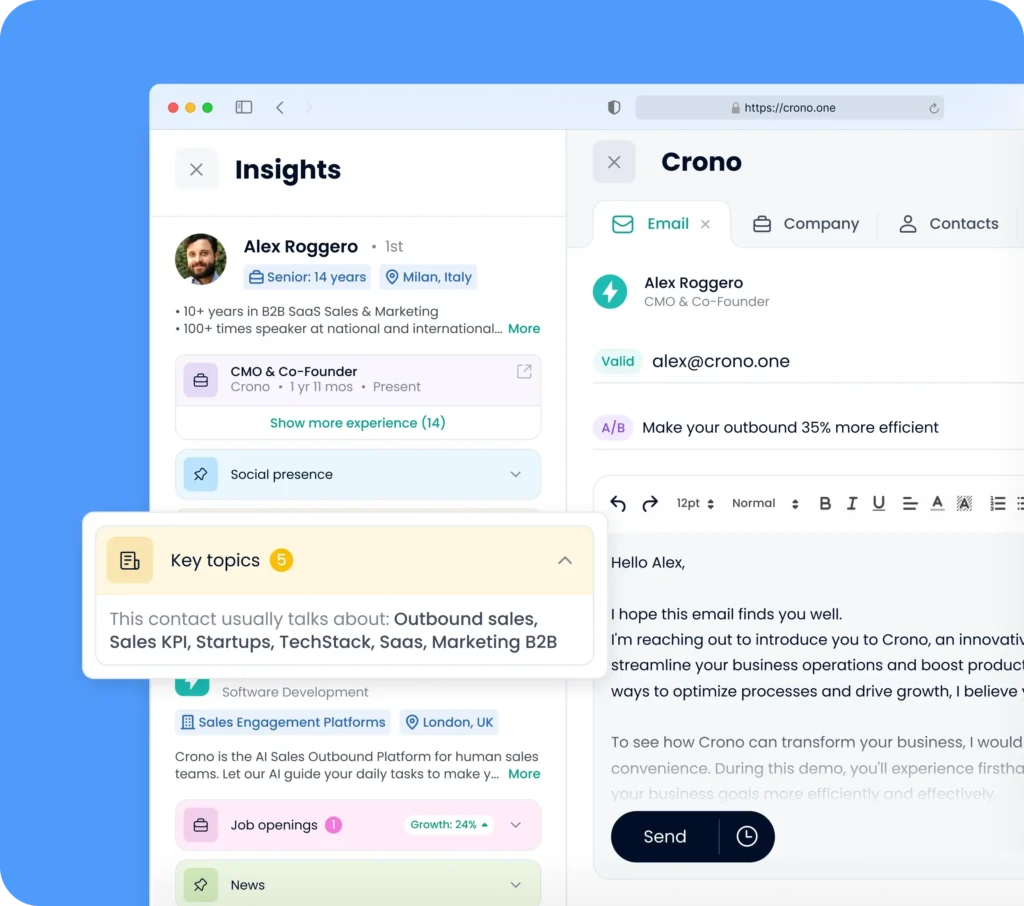

SDR tools like Crono let you record notes after each call and tag prospects based on their body language signals—like enthusiasm, hesitation, or skepticism. Even better, these notes and tags are instantly visible to everyone on your team. So, whether it’s a follow-up email, a LinkedIn touchpoint, or a handoff to an AE, everyone can pick up the thread seamlessly in the next touchpoint.

2. Asking highly specific questions

- Signal strength: Strong

- Buying journey stage: Decision stage

Highly specific, thoughtful questions are a classic sign that you’re most likely their vendor of choice. They indicate the prospect is committed to closing the deal, and shows:

- High cognitive effort: They’ve invested real time in understanding their challenges and are searching for the right fit.

- Concern with risk reduction: Detailed, scenario-based questions show they want to minimize risk before committing.

- Emotional investment: Their curiosity and persistence show it matters. The more they probe, the closer they are to committing.

It’s easy to assume they’re stalling or stringing you along. After the third or fourth round of back-and-forth, you might feel tempted to pull back to save energy.

But stepping back here is a mistake. What you really need to do is differentiate generic from highly specific questions.

For example, when interpreted in isolation, a question like “What industries do you serve?” is generic and often points to early-stage interest. But once prospects start asking about integrations, pricing structures, or onboarding, those are the signals that they’re doing real due diligence and lining up internal approvals.

Here are some common details customers ask about that indicate strong buying intent:

- Pricing or payment terms

- Onboarding processes and ongoing support

- Potential return on investment (ROI)

- Integrations with current workflows

- Implementation timelines

- Case studies from other companies that have used your tool.

How to respond

When prospects ask highly specific questions—about pricing and payment terms, for example—your responses need to de-risk their decision. Tailor your responses to address the prospect’s desired outcomes, and back every answer with proof points like ROI data, case studies, or examples from similar customers to build trust.

- If a prospect asks about integrations or onboarding, emphasize ease of use, support availability, and real-world success stories from similar users.

- Don’t just quote a price for a decision maker focused on pricing, ROI, and implementation timelines. Explain what they’ll get for that investment, how quickly they’ll see results, and why it’s worth it.

- Sales champions typically ask a mix of questions to make the case internally. So, support them by answering thoroughly and equipping them with tailored collateral they can use to make the case.

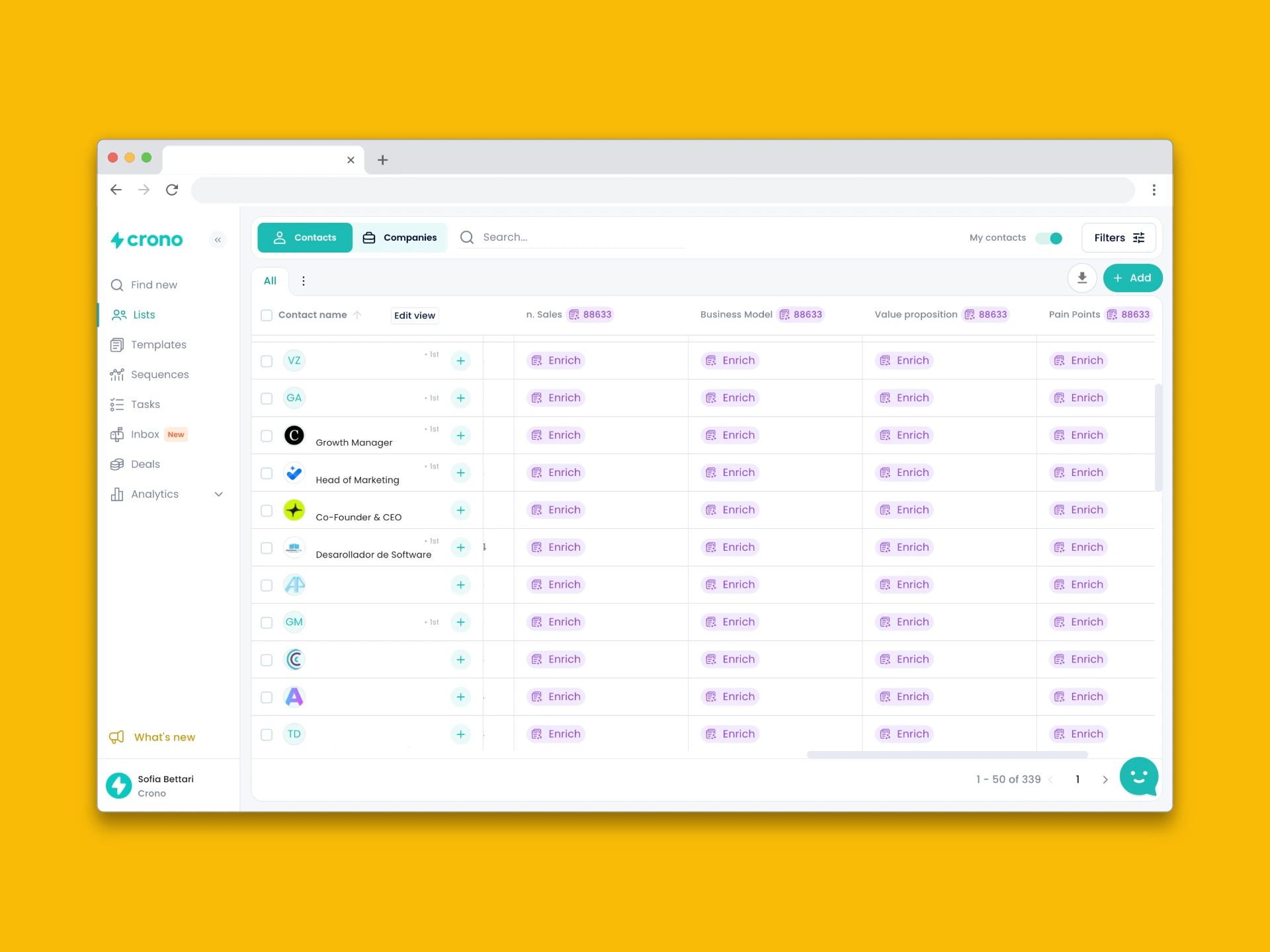

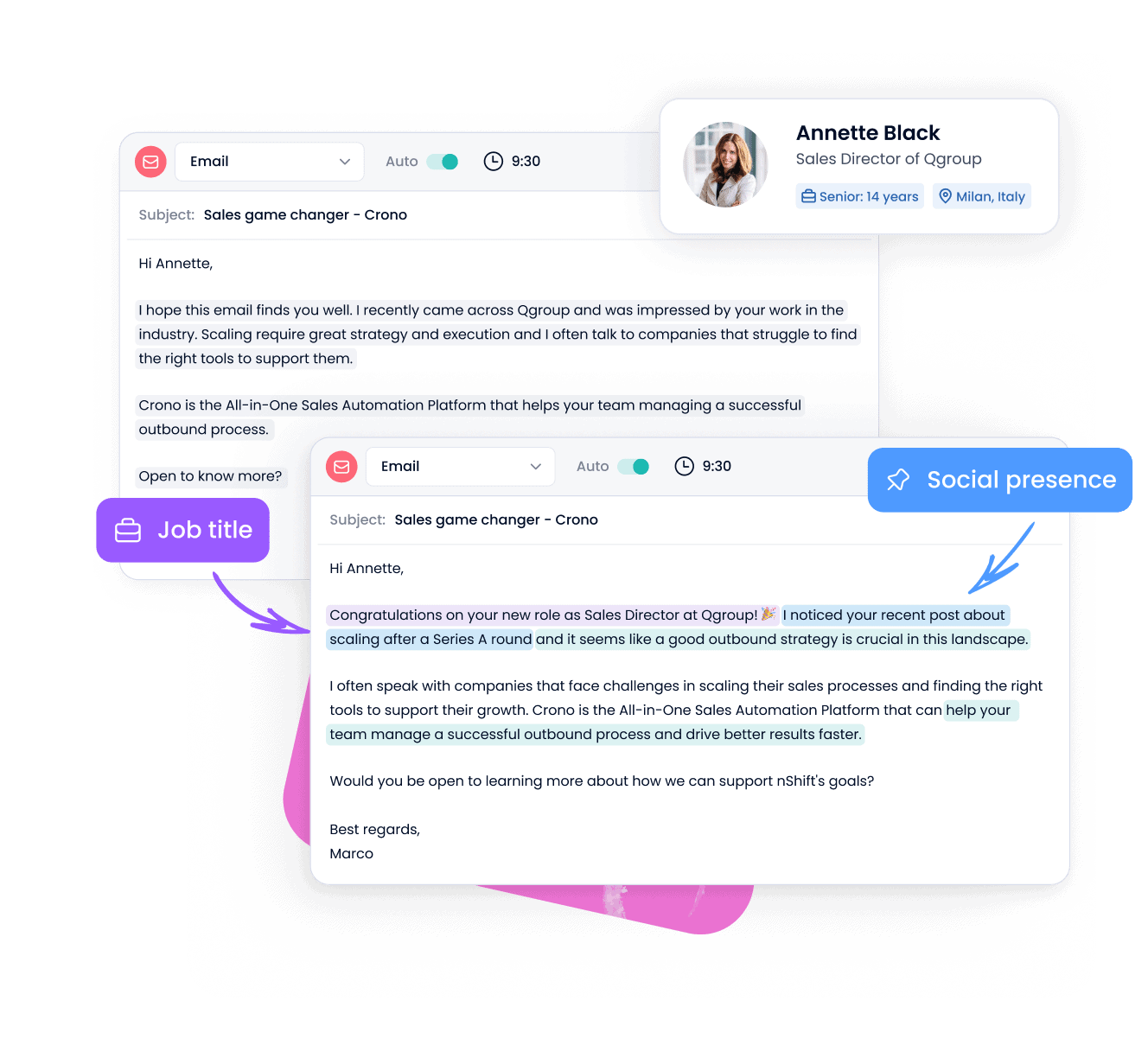

Pro tip: Tailoring your answers based on the prospect’s role and concerns can get complex, especially at scale. Crono simplifies this by letting you create persona-specific message templates that you can customize with real-time insights from your prospect’s behavior.

Whether you’re speaking to end users worried about onboarding or decision-makers focused on ROI, Crono ensures your outreach always resonates.

3. Engagement that indicates they’re open to continuing the conversation

- Signal strength: Moderate to strong

- Buying journey stage: Consideration to decision

Your contacts are typically busy professionals who only make time for things that directly tie to their goals or solve a real problem.

So, their willingness to engage, even if it’s something as simple as clicking a link to sales collateral in your outreach message or as big as suggesting a “quick call,” can signal genuine interest.

Some signs that show a prospect is looking to continue the sales conversation include:

- Clicking links to sales collaterals like case studies and whitepapers, in follow-up emails.

- Referencing your materials during calls or replies.

- Requesting more information, like pricing, integration details, or technical specs, and customer success stories.

- Responding promptly to outreaches.

- Reaching out unprompted to continue the discussion.

How to respond

Generally, you want to take full advantage of their enthusiasm and use it to close the deal. To do that, you should respond within 24 hours or less.

Here’s a template you can use:

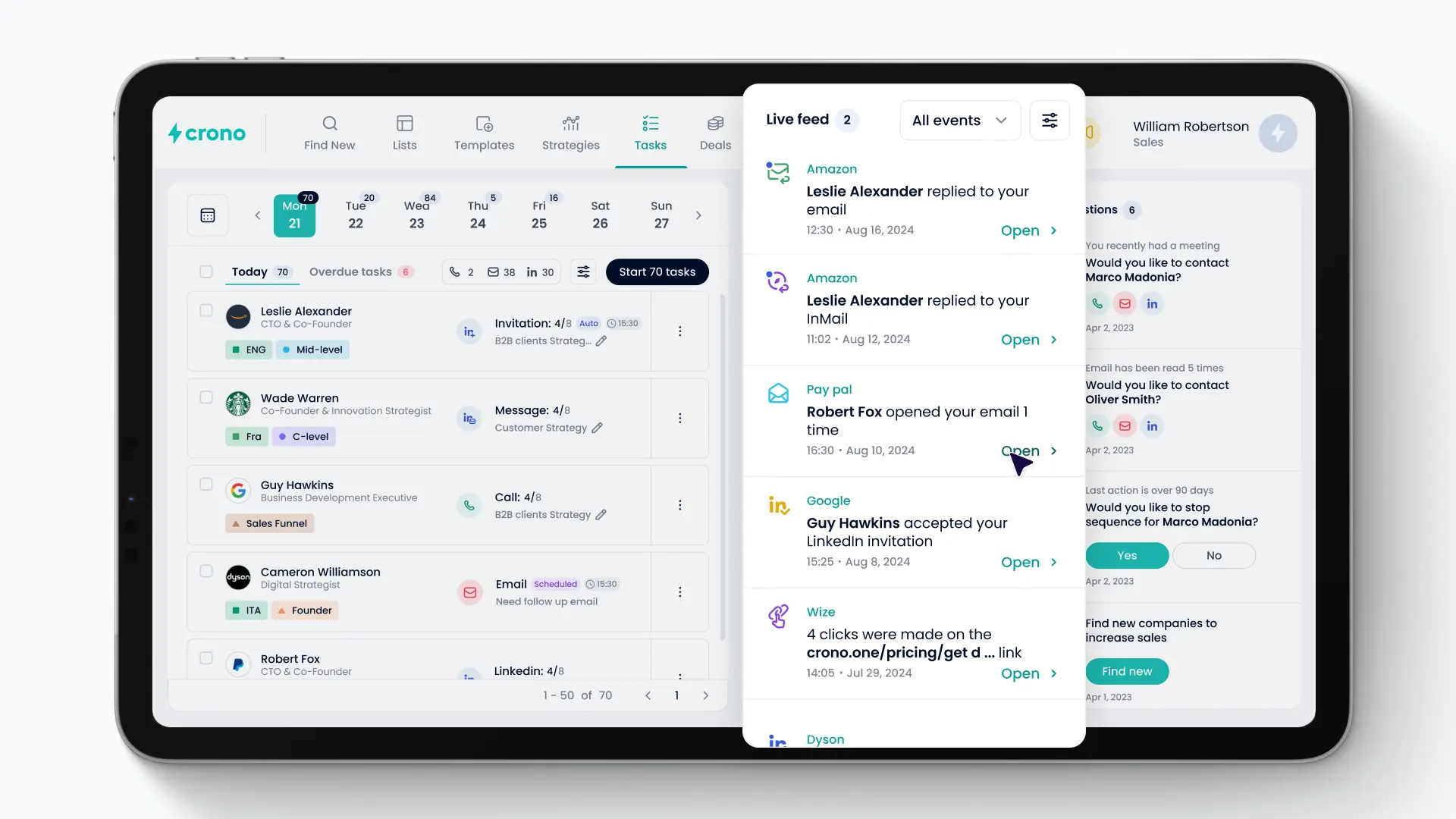

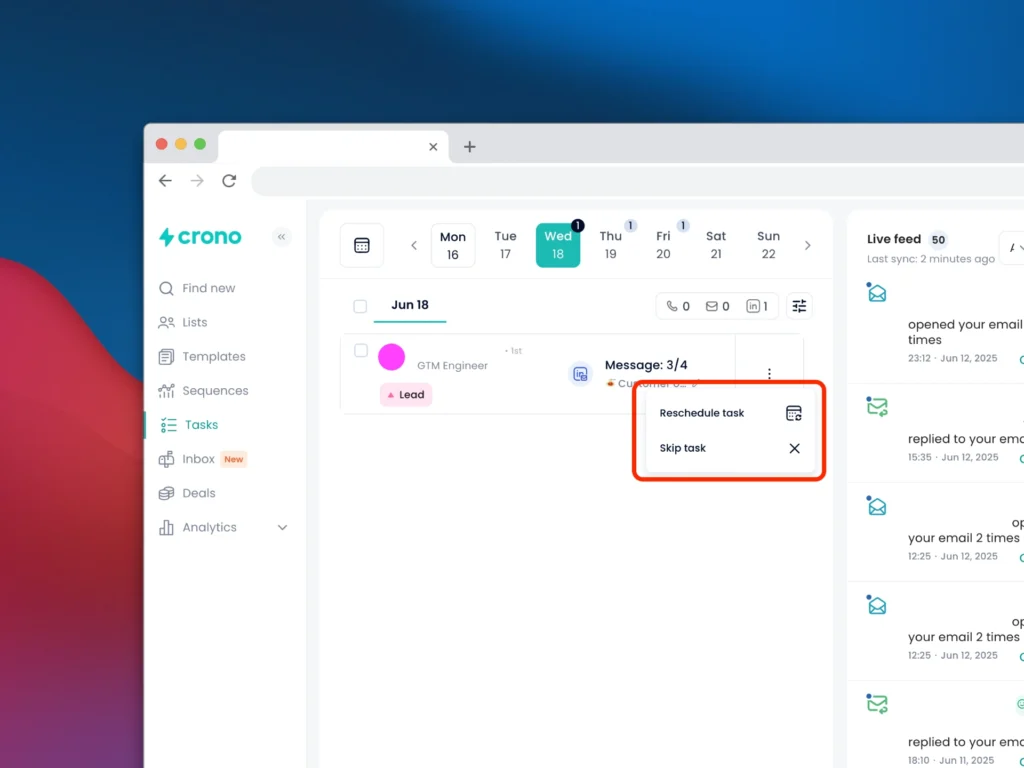

Pro tip: With Crono’s live feed, you can see exactly when a prospect opens your email, clicks a link, or engages with your LinkedIn message, making it easy to follow up while you’re still top of mind.

And with the Inbox feature, you can have all your messages from different channels directly in one place.

4. Disclosing displeasure with the current solution

- Signal strength: Strong

- Buying journey stage: Mid to Late (Evaluation)

Prospect disclosing dissatisfaction with their current solution shows they’re problem-aware and actively seeking a better alternative. If you can clearly show how your product solves what their current one can’t, you can win the deal.

How to respond

At this stage, trust matters.

Your prospect may be skeptical if a past sales rep oversold a tool that didn’t deliver. The best way to earn their trust now?

Be upfront about what your product can—and can’t—do. While it’s important to position your tool as a better alternative, avoid exaggerating or misrepresenting what it can do.

Lastly, reduce switching costs. Highlight features that make it easy to migrate from their current setup, such as:

- A dedicated onboarding and migration support to ensure a smooth transition without downtime or data loss.

- Flexible API options and native integrations with major platforms that their team uses.

- Short implementation timelines have been proven by a case study featuring a company of similar size.

- A dedicated customer success manager who will be their ongoing point of contact to help them maximize value.

- Quick return on investment strengthened by case studies.

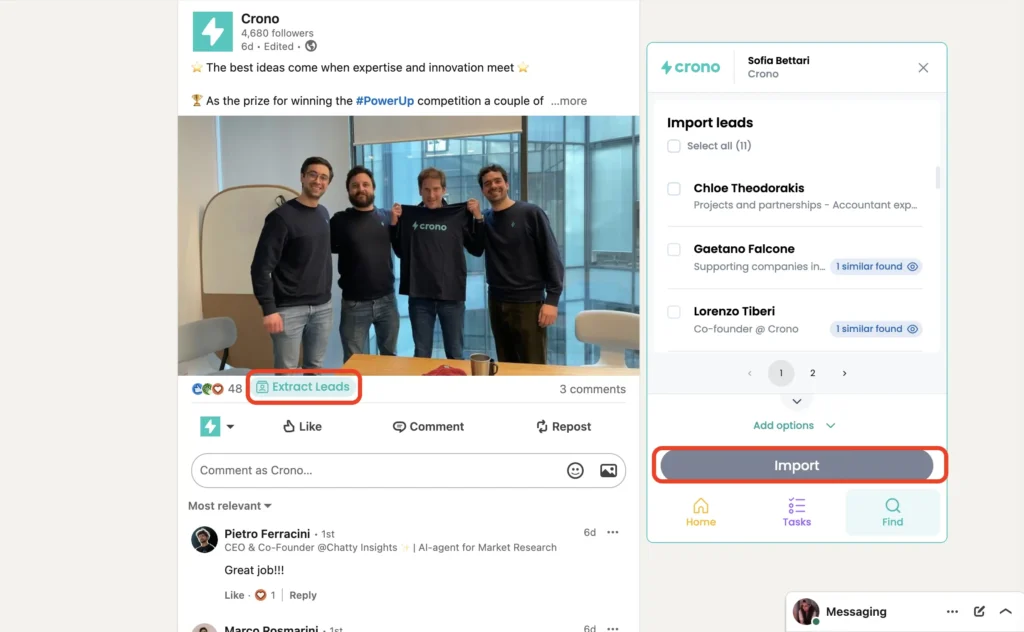

Pro tip: You don’t have to wait for complaints to come to you. With Crono’s Extension, you can extract leads while browsing LinkedIn.

For example, if you’re doing social selling, you can instantly extract and enrich the contact details of everyone who engaged in a post expressing dissatisfaction with a competitor’s product. Then, add those prospects to a nurture sequence with messages tailored to their pain points.

5. Demo or free trial requests

- Signal strength: Strong

- Buying journey stage: Decision

Demo or free trial requests indicate that the prospect actively evaluates your product as a potential solution. At this stage, they’re likely comparing vendors, looking for a fit, and trying to validate your claims.

Your goal now is to guide them through the experience, highlight the features that match their use case, and show clear ROI.

How to respond

If a prospect requests a demo, use this opportunity to dig deeper and qualify them better by:

1. Asking questions like:

“What prompted you to check us out?”

“Are you comparing other tools?”

“What specific challenges are you hoping this solution will address?”

“Have you used similar tools before? If so, what did you like or dislike about them?”

“Is there a particular use case or project you want to focus on during the demo?”

Consider adding these to your demo request form to gather insights upfront.

2. Tailor your demo to their responses.

Focus on workflow and pain points that matter to the prospect the most.

For free trials, collaborate with the product team to track usage patterns with activity tracking software to see which features prospects engage with or struggle with.

Use these insights to send timely, helpful follow-ups like:

“Noticed you started a trial last week, and that you’ve been exploring X features. Just checking in to see how it’s going. Let me know if you’d like tips on getting the most out of it.”

Done right, this proactive engagement shortens sales cycles and improves demo- and trial-to-close conversion.

Pro tip: Use Crono to quickly review past interactions and uncover the prospect’s specific pain points. This lets you tailor your demo and follow-up messages to focus on the features and outcomes they care about most.

6. Repeatedly visiting the pricing and demo request pages

- Signal strength: Strong

- Buying journey stage: Decision

If someone keeps returning to your pricing or demo pages, it usually means one thing: they’re deep in evaluation and trying to decide if your solution fits their needs and budget.

They’re also likely sharing this information internally to get the go-ahead from higher-ups to reach out.

How to respond

Tailor your outreach based on the visitor’s behaviour.

For example, if someone is repeatedly visiting your integration pages or developer documentation, they’re likely focused on how your product fits into their existing systems.

That’s a good cue to follow up with technical docs, API guides, or an invite to a hands-on webinar that addresses implementation questions.

Conversely, a person who keeps returning to your pricing page is probably weighing ROI and budget alignment. In this case, consider leaning into flexible pricing, payment options, or onboarding support— any move that provides a clear path to time-to-value.

7. Looping in stakeholders

- Signal strength: Strong

- Buying journey stage: Evaluation to decision

Prospects bringing in colleagues usually mean they see potential in your solution and want to build internal alignment.

This signal gets even stronger when senior decision-makers—like managers, department heads, or executives—get involved. Senior stakeholders are only looped in when the buying process is well advanced and it’s time for the final evaluation and sign-off.

How to respond

When other stakeholders are involved in the sales process, you’re no longer trying to convince just one person. You have to adjust your approach to build consensus among the various stakeholders:

- Ask who’s involved and why

Start by identifying the key players:

“Totally get that. But, just so I can support the conversation, who else usually weighs in on a decision like this? And what do they typically care about most?”

- Build consensus

Send short, skimmable summary emails after meetings. These should address the concerns of each stakeholder group and be easy to forward internally.

- Prepare for multi-threaded conversations

Not everyone needs the same pitch. Prepare a simple bundle of resources for each stakeholder: a one-pager for leadership, an ROI calculator for finance, and a technical FAQ for IT.

Offer to run short, role-specific calls to determine what matters most to each stakeholder.

- Re-qualify the deal

Once multiple stakeholders are involved, confirm their intent and timeline:

“Out of curiosity, if everyone’s on board — what’s your timeline for moving forward?”

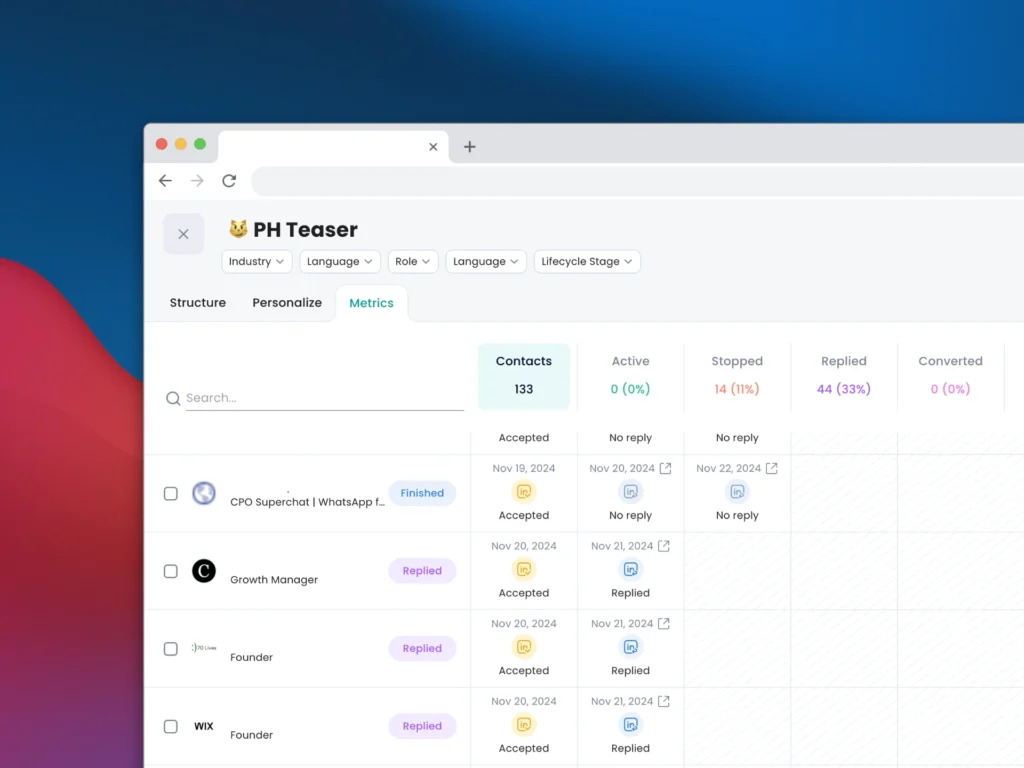

Pro Tip: Crono lets you insert dynamic placeholders into your message sequence, so each prospect automatically gets a version personalized to their role, title, or industry.

If you already have a sequence, you can use Crono’s Rewrite With AI feature to instantly tailor hundreds of messages for a new stakeholder brought into the sales process. No need to rewrite each one manually.

That way, you can highlight the most important outcomes to each stakeholder and address the objections they’re most likely to raise.

8. Appointing new leaders

- Signal strength: Weak to moderate

- Buying journey stage: Awareness to evaluation

When a company appoints a leader in the C-suite, it often signals they are ready to buy. Why?

New leaders are expected to make an impact quickly. So, they look for a quick win. They will review existing tools to identify underperforming systems and look to replace them with a solution that can deliver quick wins and align better with their strategy.

That’s a massive window of opportunity, if you act fast.

How to respond

- Don’t jump straight into a product pitch. Instead, acknowledge the leadership change and offer something valuable or insightful that aligns with their likely goals:

“Saw you recently joined as Head of Sales at [Company]—congrats! If you’re reviewing current workflows, I can share how teams like yours cut rep ramp time by 30% with [Your Tool]. Let me know if you’d like a quick overview.”

- Position your solution as a way to fulfill their mandate.

Frame your product as a tool to help them engineer a quick win, whether by reducing costs, speeding up onboarding, or improving visibility.

Pro Tip: Build rapport before reaching out. Follow new leaders on LinkedIn and engage with their posts. That way, your message won’t feel cold when it lands in their inbox.

9. Hiring Spikes

- Signal strength: Weak to moderate

- Buying journey stage: Awareness to evaluation

For example, a company building out a new SDR team will soon need prospecting tools. If they’re expanding CX, they’ll likely look for helpdesk software. And if they’re scaling RevOps, they’ll need forecasting tools and integrations across their GTM stack.

Spotting these hiring patterns early allows you to sell your product as an essential investment before a competitor gets there first.

Before reaching out, dig into job descriptions, manager posts, or team updates to understand why they’re hiring.

Are they simply replacing employees who left? Or does it signal a long-term investment in a newly established team, like Sales Ops, CX, or RevOps? Is it just a seasonal push, like Q4 ramp-ups or pre-conference staffing?

Understanding the why behind the hiring is critical to crafting a relevant message.

How to respond

During hiring spikes—especially when building new teams—companies may still be evaluating which tools are truly necessary.

Your best move? Show that you understand the “why” behind the hires (e.g., outbound push, CX investment, process scaling), and explain how your product can accelerate success for the new team.

You could frame it as:

“Saw you’re building out a [team type] function. Exciting milestone! At this stage, most companies are figuring out how to scale [X process] without adding friction. Happy to share what we’ve seen work across similar teams.”

Or:

“Noticed you’re hiring your first [job title]. When companies hit that point, they often start looking at [category/tool] to give the new team structure and speed from day one. Want me to send a quick playbook or checklist on what to look for?”

Pro tip: Pair this signal with others like recent funding, leadership hires, or tech stack changes to get a fuller picture of the strength and urgency of this buying signal.

10. Repeated engagement with content

- Signal strength: Weak

- Buying journey stage: Awareness to evaluation

A prospect engaging with your content is likely a mid-to-late-stage buyer who is trying to learn more about your tool and others included in their shortlist.

But not all content engagement signals equal buying intent. The type of content they consume makes a big difference.

For example, frequent visits to bottom-of-funnel materials—like whitepapers, case studies, product demos, or ROI calculators—usually indicate strong purchase intent.

In contrast, repeated visits to general blog posts or educational content may not mean they want to buy. Prospects may simply be gathering knowledge on a topic.

How to respond

The key is to acknowledge the content they have consumed and personalize your outreach based on that. Here’s how:

- Map content themes to likely pain points.

Use the specific content they’re engaging with to identify their likely pain points, then tailor your follow-up accordingly:

“I noticed you’re interested in our resource on onboarding practices. Are you scaling a new team or shifting processes? I can share how other teams are using [X] to streamline that.”

- Reference specific content in your follow-up.

Avoid vague messages like “I saw you visited our site.” Instead, demonstrate attention to detail:

“Saw you spent time on our guide to SDR automation. Teams using Crono have cut manual tasks by 60%. Want me to show you how they did it?”

- Share tailored resources based on interest.

Use their content interests as a springboard to share relevant playbooks, comparison guides, or video walkthroughs that can help move them closer to a purchase decision:

“Since you’re focused on [X] and thought you’d find this short video on [Y] useful. It explains [give a mini breakdown]”

11. Securing significant cash infusions

- Signal strength: Weak

- Buying journey stage: Awareness or evaluation

News of a company securing fresh funding or significantly exceeding revenue targets is a strong indicator that they have a larger budget to invest in new solutions. Such events typically coincide with plans to scale—like hiring for multiple roles and expanding into new markets, which often require new software, services, or infrastructure.

How to respond

A prospect that has just experienced a cash infusion is less concerned about cost. What they want to understand is the strategic value your tool can bring, something most sales reps won’t take the time to articulate..

For example:

“Congrats on the recent fundraise. [Briefly explain your company’s key differentiator and how it aligns with their needs.] We’ve helped companies similar to yours achieve [mention a specific quantifiable result or success story].

I’d be happy to schedule a brief 15-minute call to explore how [Your Company/Service] might be a good fit for [Company Name]. Would you be available for a quick chat sometime next week?”

Pro tip: Timing matters.

Don’t wait weeks after a funding announcement to reach out. In the days following a raise, leadership teams are actively evaluating where to deploy capital. You want your message to be part of that conversation.

How To Influence Buying Signals & Use Them To Your Advantage

Regardless of the strength of a buying signal, you can turn it into a sales opportunity with the right approach, one of which is personalization.

After all, 86% of business buyers say they’re more likely to purchase when a rep understands their goals, according to Salesforce. Yet, 59% say most reps don’t take the time to do that.

That gap is where you can make a real difference.

Beyond personalization, influencing buying signals means backing your outreach with proof points that show how your solution fits their unique needs, and using the right tools to uncover buying intent.

Here’s how to do it:

Respond fast

When a prospect shows interest, responding quickly lowers the chance they’ll turn to a competitor. Early outreach also helps you shape the conversation before others jump in.

To act fast, track intent signals across digital platforms, and keep follow-ups organized in a central system.

Crono simplifies this by managing all your multichannel sales activities—from email to LinkedIn and calls—in one place. No need to switch between tools to track buying signals.

Plus, its task manager lets you schedule and assign follow-ups so no lead slips through the cracks while the signal is still warm.

Document buying signals for sales training & enablement

Record common buying signals and how your team responds to them. This knowledge base becomes a go-to playbook for reps facing deal challenges and a source of benchmark data to predict buying intent more accurately.

To build your database:

- Identify frequent buying signals across accounts and what they typically mean.

- Link each signal with recommended next steps, objection-handling tips, and success stories your team can learn from

Collaborate with marketing to create buyer enablement content

You’re on the front lines, hearing prospect questions, objections, and what messaging resonates.

Share these insights with marketing so they can craft targeted resources—like short videos, use cases, comparison guides, or “getting started” playbooks.

That way, you’ll always have a tailored resource for closing buying signals.

Use the right tools to spot the deep data around buying intent

Intent signals like whitepaper downloads or pricing page visits only tell part of the story. To respond effectively, you need context:

- Which personas are engaging and how often?

- What content do they return to?

- Are key stakeholders involved?

- Are there recent hires, budget changes, or leadership shifts behind the scenes?

The right sales tools provide this rich data, helping you tailor your outreach and timing perfectly.

Sales Signals Often Mistaken for Buying Intent

Earlier, we made an important distinction: not every signal that shows interest reflects true buying intent.

But in the rush to fill pipelines, it’s tempting to treat every flicker of interest as a green light to sell. Reps see a spike in website visits or a new LinkedIn follower and assume it’s time to pitch.

That’s how reps end up chasing low-quality prospects instead of real sales opportunities.

Here are four common signals that often get misread, and what they really mean:

1. Website traffic spikes: A bump in website visits can feel exciting. But unless those visits come from the right personas at the right companies, show repeated visits, they often reflect surface-level interest or curiosity, not intent.

2. Social media engagement: Someone liking, sharing, or commenting on your post just means they found the content interesting. Don’t treat it as a buying signal unless they also show stronger intent elsewhere, like visiting your pricing page or downloading a bottom-of-funnel asset.

3. Podcast mentions: Getting cited in a podcast usually means your brand is known, not that the speaker is thinking of buying it. It only becomes a green light to sell if the speaker clearly references your solution as something they’re actively exploring.

4. Webinar registration (without follow-up action): A name on a registration list isn’t a qualified lead, especially if they didn’t show up or stayed silent throughout. Many register to access the recording later. Unless they attend, follow up with questions, or take the next step (like booking a demo), they’re not ready to buy.

CTA: Turn Every Sales Signal Into a Sales Opportunity With Crono

Spotting a signal is just half the battle. Acting on it at the right time, with the right message, turns interest into actual sales conversations. But when your sales team is juggling tabs and relying on manual workflows, these moments of purchase intent can slip away.

That way, you’ll always have a tailored resource for closing buying signals.

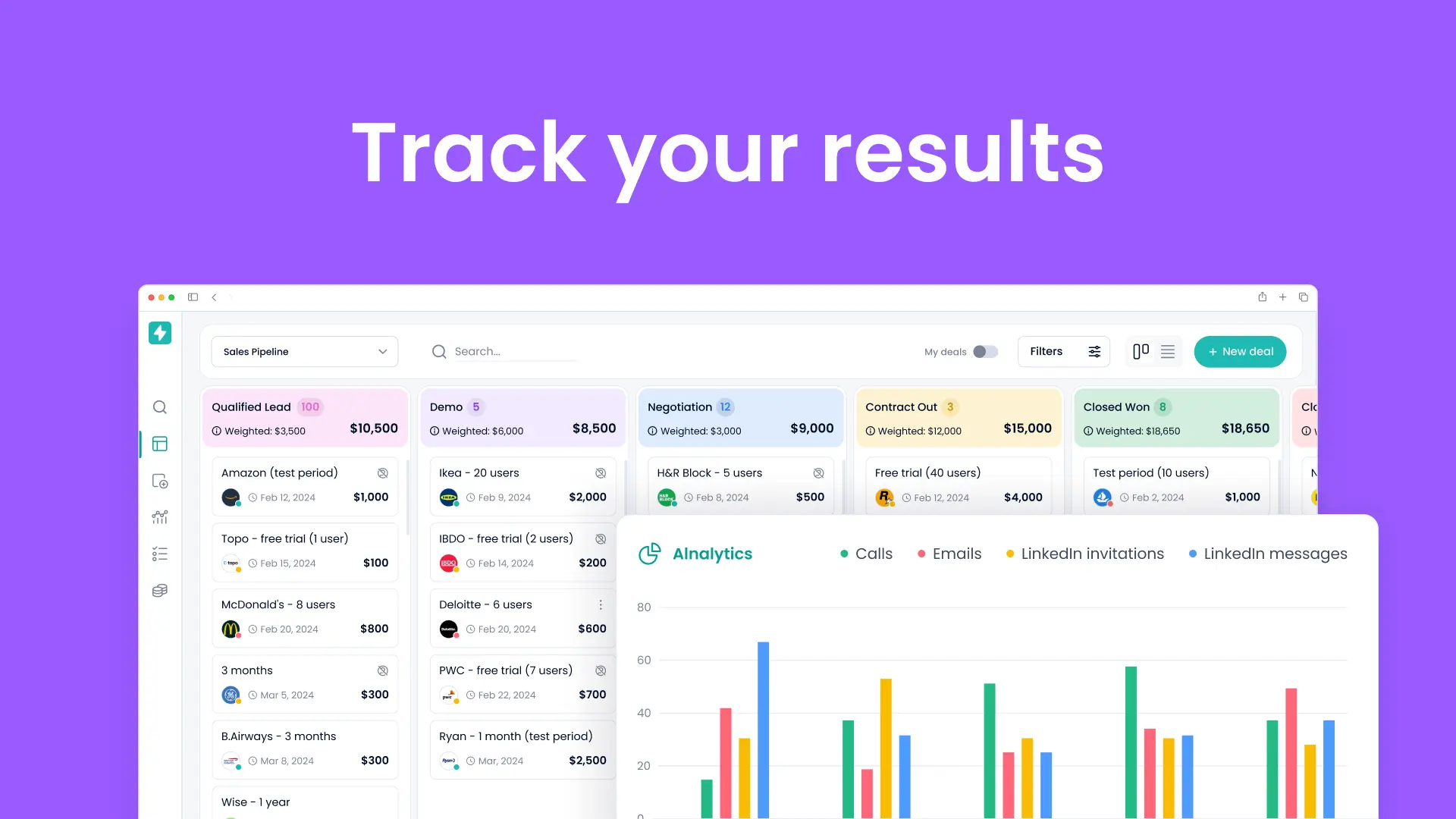

Crono lets you manage your entire sales motion in one place. This helps your sales teams spot buying signals across channels—whether email opens, sales collateral downloads, or pricing requests—and act on them promptly.

Every interaction is recorded and logged in the Task Manager, so SDRs, BDRs, and AEs get the context they need to continue the conversation and close the sale.

When it’s time to respond, Crono makes it fast.

Sales teams can use our AI tools to create personalized message templates, icebreakers, LinkedIn replies, and emails. So, whether you’re running an outreach to a hundred or thousand prospects, each person gets a message that fits their role, industry, and current pain points.

Best of all, as the conversation proceeds, Crono will provide you with the support you need to close the deal.

Its AI engine will recommend next-best actions, based on the engagement history and what has worked in the past. That means fewer stalled deals and more forward momentum that closes sales.

With Crono, you’re getting a tool that not only helps you spot signals but also acts on them promptly and with the right message.

Manage your entire outreach in one place and convert buying signals to sales. [Book a demo now].